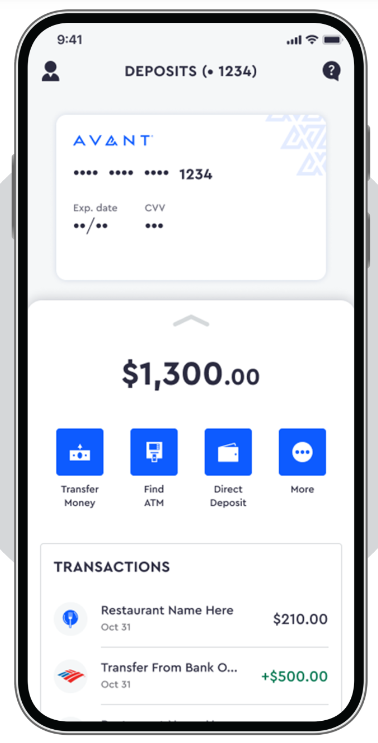

avant cc

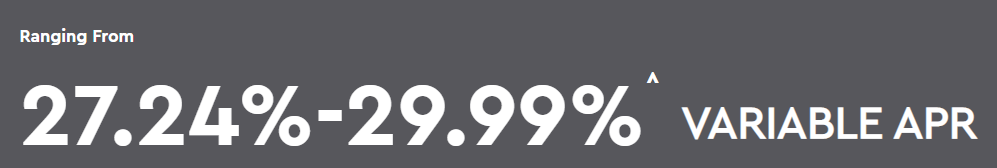

In this Avant credit card review, we will certainly review whether or not this card is a great suitable for those with a limited credit rating. Although the AvantCard does not influence your credit report when you use, it is an unsafe product that does have a little credit limit The Avant Personal Loan 2022, on the other hand, does not require a credit history whatsoever. The consumer reviews and contrast graph listed below should be helpful for those that are considering looking for this personal loan.

The Avant credit card is a strong option for a credit-building individual with reasonable to ordinary credit rating. The annual fee is economical and the credit line is a decent beginning factor. The Avant card likewise permits you to prequalify without a hard pull on your debt. As long as you more than the age of eighteen, this sort of credit card is an superb choice for establishing a solid credit rating. The Avant credit card review also highlights the benefits and downsides of this credit card.